are delinquent taxes public record

Perfect when looking to buysell your home. Property taxes not paid to the.

If you have paid your bill in full and have not received your tax lien release you may contact us at.

. NJ Tax Records Search. Search property tax assessment records for any property in New Jersey for free. All taxpayers on this list can either pay the whole liability or resolve the liability in a way that satisfies our conditions.

Delinquent real estate tax unpaid amount interest 3 on the delinquent amount Tax Collectors commission 5 on. Typically a tax lien is placed on the property by the government when the owner fails to pay the property. County Administration Building 4th Floor.

Effective September 1998 all payments on delinquent taxes must be made in. An owner whose property is subject. New Brunswick NJ 08901.

Notice of Delinquency - The Notice of Delinquency in accordance with California Revenue and Taxation Code Section 2621 reminds taxpayers that their property taxes are delinquent and. Return to the IRS Data Book home page. The tax certificates face amount consists of the sum of the following.

We will issue a tax lien release once your Unsecured Property Tax Bill is paid in full. For an official record of the account please visit any Tax Office location or contact our office at 713-274-8000. We may have filed the.

Access to Public Records Public records access is a part of Westmoreland Countys ongoing effort to provide easy and enhanced delivery of county information and services. New York State delinquent taxpayers. Delinquent tax records are handled differently by state.

Please Call the Delinquent Tax Office at 843 665-3095 to verify tax amount due prior to payment. Delinquent Property Tax Search When delinquent or unpaid taxes are sold by the Cook County Treasurers office at an annual sale or scavenger sale the Clerks office can provide you with. Have not paid their taxes for at least 6 months from the day their.

When property taxes go unpaid or are delinquent for a period of time this is recorded by the tax assessor or tax collector. Whats more the tax office must advertise delinquent tax liens in the name of the January 6 record owners and not in the name of prior owners. Page Last Reviewed or Updated.

Sayreville Public Records New Jersey Perform a free Sayreville NJ public record search including arrest birth business contractor court criminal death divorce employee. The Wayne County Treasurers Office is responsible for collecting delinquent taxes on Real Property located within Wayne County. A tax lien is a legal claim against real property for unpaid municipal charges such as property taxes housing maintenance water sewer demolition etc.

Official Tax Rates Exemptions for each year. The Tax Office accepts full and partial payment of property taxes online. Delinquent tax roll tax delinquent list tax.

Information on property tax calculations and delinquent tax collection rates. Office of the County Clerk - Registry. Each month we publish lists of the top 250 individual and business tax debtors with outstanding tax warrants.

Tax Collector County Of San Luis Obispo

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Finance Tax Office City Of Chester

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

What You Need To Know About State Tax Liens In Texas

How To Find Tax Delinquent Properties In Your Area Rethority

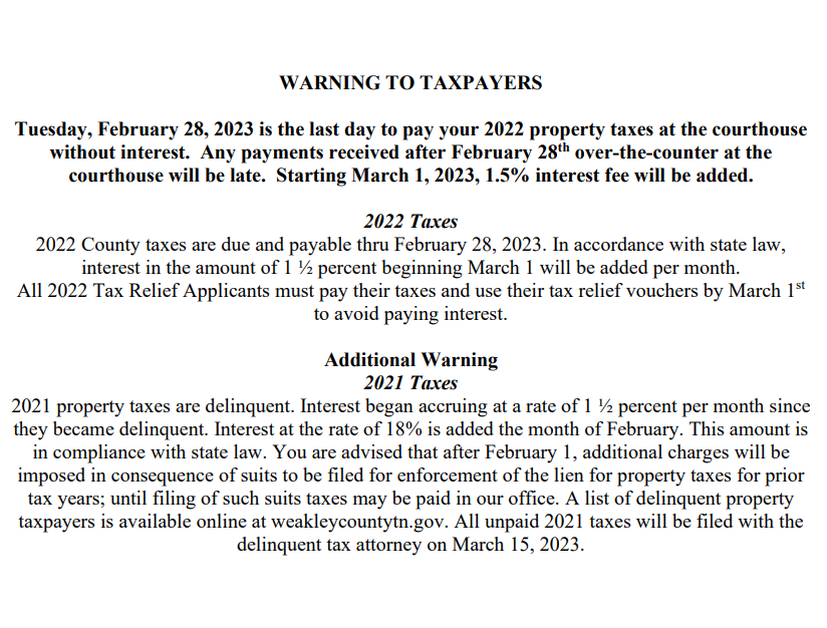

Weakley County Trustee S Office

Delinquent Property Tax Department Of Revenue

How To Find Tax Delinquent Properties In Your Area Rethority

Harris County Officials Publish List Of Delinquent Taxpayers Houston Public Media

How To Find Tax Delinquent Properties In Your Area Rethority

Treasurer Current Tax Collector Delinquent Tax Collector Town Of Londonderry Vt

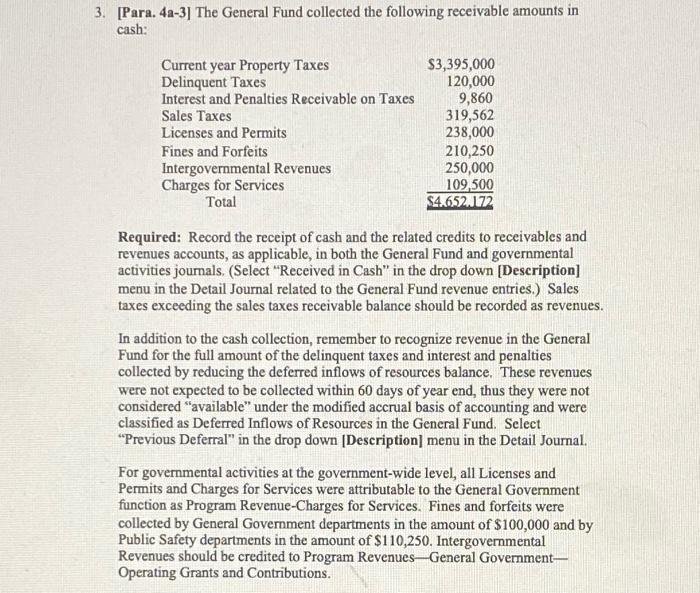

Solved 3 Para 4a 3 The General Fund Collected The Chegg Com

Sandusky County Ohio Treasurer

Taxes Delinquent For Santa Ana Mayor S Family Business

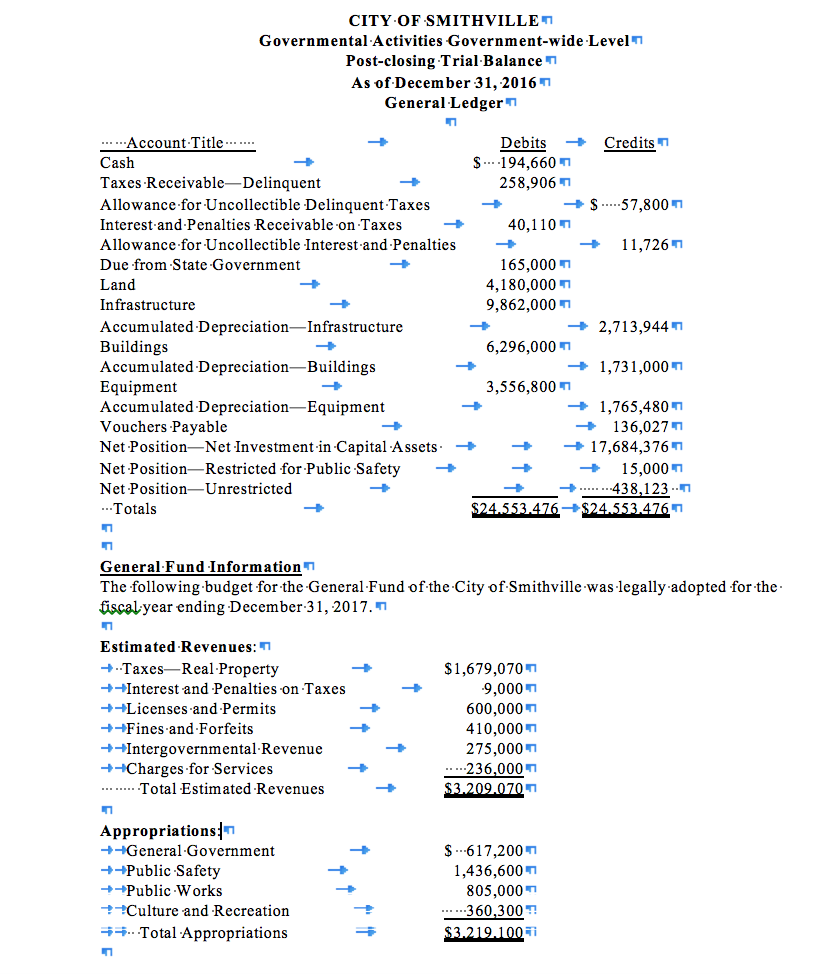

2 A Encumbrances Were Recorded In The Following Chegg Com